dlkfs.online

Overview

Suncoast Ach Transfer

I've had car loans, a mortgage, savings/checking for me and our kids, credit card. They don't charge many of the fees banks do. I even worked. Account Number This is your checking account number. How do I find my Suncoast member ID? If you need help finding your member number or SunNet password. 1. How to transfer money from one bank to another? · 2. ACH transfer and a wire transfer: what's the difference? · 3. How many digits does a routing number have? How many stars would you give Suncoast Credit Union? Join the 29 people who've already contributed. Your experience matters. The limit for Alliant ACH transfers is $ per day. My 82 year old mother, suffered a fraudulent ACH transaction on May 2, for $ The ** fraud resolution. Suncoast members can transfer funds or set up recurring You can also pay bills automatically with ACH payments, from accounts outside of Suncoast. Once logged into Online Banking, you will see the Pay-A-Person Person-to-Person (P2P) and Account-to-Account (A2A) services in the toolbar within the “Transfer. is a routing number used for SUNCOAST CREDIT UNION in FL. This routing number supports ACH and Wire transfers. I've had car loans, a mortgage, savings/checking for me and our kids, credit card. They don't charge many of the fees banks do. I even worked. Account Number This is your checking account number. How do I find my Suncoast member ID? If you need help finding your member number or SunNet password. 1. How to transfer money from one bank to another? · 2. ACH transfer and a wire transfer: what's the difference? · 3. How many digits does a routing number have? How many stars would you give Suncoast Credit Union? Join the 29 people who've already contributed. Your experience matters. The limit for Alliant ACH transfers is $ per day. My 82 year old mother, suffered a fraudulent ACH transaction on May 2, for $ The ** fraud resolution. Suncoast members can transfer funds or set up recurring You can also pay bills automatically with ACH payments, from accounts outside of Suncoast. Once logged into Online Banking, you will see the Pay-A-Person Person-to-Person (P2P) and Account-to-Account (A2A) services in the toolbar within the “Transfer. is a routing number used for SUNCOAST CREDIT UNION in FL. This routing number supports ACH and Wire transfers.

Suncoast Account Statement. Member Number: 06/01/ - 06/15 05/03/ 05/03/ Withdrawal ACH BANKCARD DEPOSIT TYPE: FEES. Just enter the amount to transfer and the recipient will receive a text or email with instructions on how to receive it. Fees: Most standard transfers are no-. U.S. checking or savings account required to use Zelle®. Transactions between enrolled consumers typically occur in minutes. Check with your financial. Suncoast Account Statement. Member Number: 02/01/ - 02/28 02/01/ 02/01/ Withdrawal ACH ADP PAYROLL FEES 68, TYPE. At Suncoast, we do everything with our members in mind. Because we're not for profit, we can offer many benefits most banks don't from our lower interest rates. CAN I SET RECURRING TRANSFERS? Yes, you can set up a one time or recurring transfer. WHAT OPTIONS ARE AVAILABLE TO THE RECIPIENT TO RECEIVE THE MONEY? withdrawal, automatic payment (ACH) transaction, or recurring debit card payment. If you have given SUN Credit Union authorization, we may also cover ATM. SHOULD SUCH AN ATTEMPT BE MADE, THE CREDIT UNION RESERVES THE RIGHT TO SEEK REMEDIES AND DAMAGES (INCLUDING ATTORNEY FEES) TO THE FULLEST EXTENT OF THE LAW. If there is a suspicious transaction on your account, you might get a call from our risk management team. Since criminals know that. Transactions are processed by the bank through the Automated Clearing House (ACH) network, the secure transfer system that connects all U.S. financial. Venmo would work just fine. You add your account to Venmo, send it to the recipient, and now it's on them to get the money transferred to their. WIRE TRANSFER INSTRUCTIONS. WIRE TRANSACTIONS. INCOMING WIRES ‐ FEE: $ First routed to: Corporate One. ABA# Coolidge Ct. Tallahassee, FL. Nine business days is the maximum “funds availability delay” that's generally allowed under Federal regulations. Bank-to-bank transfers Transfer money between your accounts at Wells Fargo and other U.S. financial institutionsFootnote 1, and skip the trip to the bank. I recently used Suncoast for my Auto loan. I usually pay off my loans quickly by making principle-only payments. I made a significant principle-only payment. Unbeknownst to consumers, each time Suncoast reprocesses an ACH transaction or check for payment after it was initially rejected for insufficient funds. Whether that's ACH (Automated Clearing House) transactions (mobile check deposit, peer-to-peer transactions, etc.) or wire transfers, the Federal Reserve's. Spring Hill - Suncoast · hour ATM (accepts deposits) · Commercial Real Estate Loans · Instant Issue Debit Cards Available · Safe Deposit Box Available · Send. The routing number for Citizens Bank for wire transfers is For an international wire transfer, it's important to have both the wire routing number. Suncoast customers may need the Suncoast Credit Union routing number to set up an ACH transaction, such as direct deposit or automatic payment. A Suncoast.

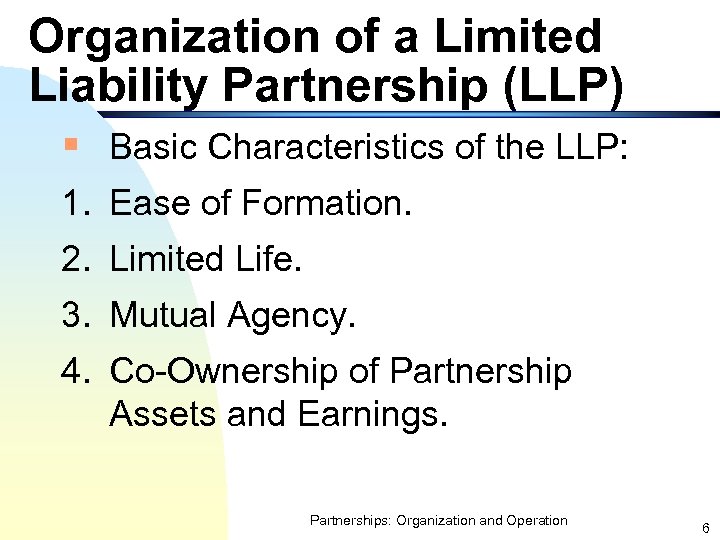

Accounting Limited Liability Partnership

This form of company is most often found in medical practices, law offices, or accounting firms where liability is a big issue. This protects innocent partners. An overview of the Companies Act provisions on the preparation of annual accounts and reports as applied with modifications to limited liability. Accounting for limited liability partnerships (LLPs) is a specialist area that requires expertise and an understanding of the business structure. LLP REGISTRATION · The foremost advantage behind the incorporation of LLP is the significant leeway it offers in terms of taxation. · Each of the members of an. dlkfs.online: Accounts and Audits of Limited Liability Partnerships: Clare Copeman, Yvonne Lang: Books. Under the Partnership Act, LLPs protect the personal assets, such as houses and RRSPs, of non-negligent public accountants. Each partner in an LLP is liable for. Applying for approval of a Limited Liability Partnership is a four-part process · The firm must obtain approval from CPABC to make any change to an existing firm. A topical summary of the new SORP for LLPs. As a reminder, the LLP SORP is effective for periods commencing on or after 1 January Under the Partnership Act, LLPs protect the personal assets, such as houses and RRSPs, of non-negligent public accountants. Each partner in an LLP is still. This form of company is most often found in medical practices, law offices, or accounting firms where liability is a big issue. This protects innocent partners. An overview of the Companies Act provisions on the preparation of annual accounts and reports as applied with modifications to limited liability. Accounting for limited liability partnerships (LLPs) is a specialist area that requires expertise and an understanding of the business structure. LLP REGISTRATION · The foremost advantage behind the incorporation of LLP is the significant leeway it offers in terms of taxation. · Each of the members of an. dlkfs.online: Accounts and Audits of Limited Liability Partnerships: Clare Copeman, Yvonne Lang: Books. Under the Partnership Act, LLPs protect the personal assets, such as houses and RRSPs, of non-negligent public accountants. Each partner in an LLP is liable for. Applying for approval of a Limited Liability Partnership is a four-part process · The firm must obtain approval from CPABC to make any change to an existing firm. A topical summary of the new SORP for LLPs. As a reminder, the LLP SORP is effective for periods commencing on or after 1 January Under the Partnership Act, LLPs protect the personal assets, such as houses and RRSPs, of non-negligent public accountants. Each partner in an LLP is still.

A firm that will be practicing public accountancy in the State of Texas as a registered limited liability partnership (RLLP) must register with the Board. Benefits of an LLP · Limited liability protects the member's personal assets from the liabilities of the business. LLP's are a separate legal entity to the. These must include at least one general partner who runs the business and has unlimited liability for any debts. The limited partners have liability only up to. CCAB has been designated the SORP making body on accounting by Limited Liability Partnerships (LLPs) and undertakes an annual review. A Limited Liability Partnership is a general partnership structure where each partner's liabilities is limited to the amount they put into the business. It seems that limited liability for an LLP means that your personal assets are protected from any malpractice committed by other partners. partnerships partners become partners of the limited liability partnership. All partnerships practicing Public Accountancy, including LLPs, must, under. They are incredibly common among lawyers, accountants, and medical professionals (hence the “LLP” you might have seen at the end of a business name). To form a limited liability partnership, the partners must register the business with the necessary state agency. The limited liability aspect is the main. Limited Liability Partnership Accounting service. An LLP will have to submit accounts and other statutory returns to Companies House. A limited partnership is a form of general partnership, which is one of three ways of organizing a business in Canada. British Columbia is the only Canadian province that does not limit the use of LLPs to the conduct of professional services (for example, a law or accounting. An LLP is an entity created by state law, usually used for professional practices, such as legal, accounting or architecture firms, says Michael J. Greenwald. SOP requires noncontrolling investments in limited partnerships (LPs) to be accounted for using the equity method as described in Opinion Accounts and Audit of Limited Liability Partnerships [Collings, Steve] on dlkfs.online *FREE* shipping on qualifying offers. Accounts and Audit of Limited. These must include at least one general partner who runs the business and has unlimited liability for any debts. The limited partners have liability only up to. Limited liability partnerships · Most important features of LLPs · Setting up LLPs or converting an existing partnership · Which businesses might want to use a LLP. Accountants for LLPs, from tax returns to long-term strategy. As specialist accountants for limited liability partnerships (LLPs), we understand the benefits. A limited liability partnership (LLP) is a partnership in which some or all partners (depending on the jurisdiction) have limited liabilities. It ensures limited liability. Partners of an LLP are not held personally liable for the wrongful acts of other partners or business debts incurred by the LLP. A.

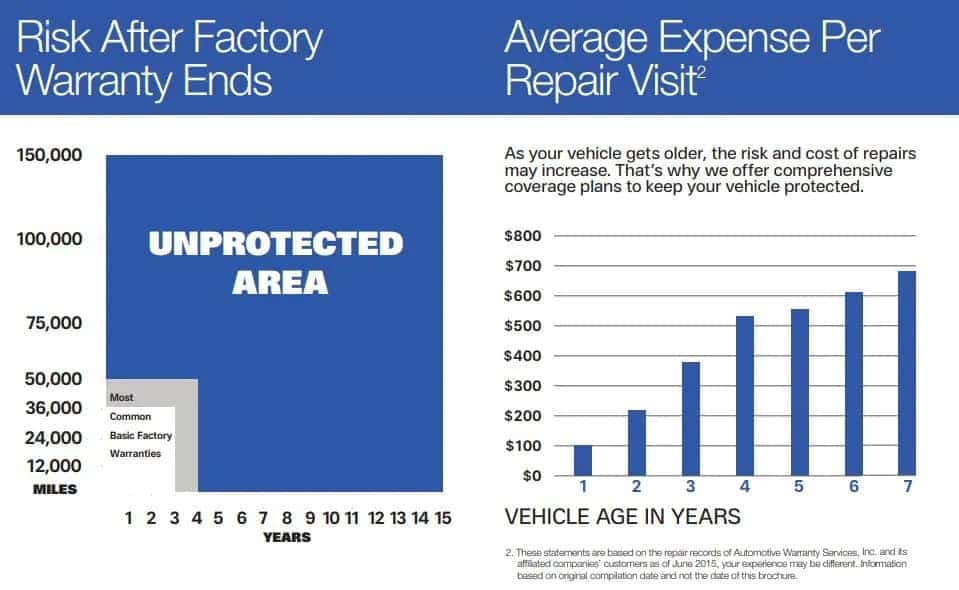

Factory Warranty Coverage

The Powertrain Warranty covers components such as the engine, transmission, and drivetrain. It begins at the Warranty Start Date and lasts for 5 years or. Year/,Mile Powertrain Limited Warranty Coverage is for 10 years or , miles for most models. Any subsequent owners receive the balance of the. Basic Coverage is 36 months/36, miles, whichever occurs first, from the date of first use and covers all components other than normal wear and maintenance. A bumper-to-bumper warranty can cover the things the powertrain warranty doesn't. It covers everything between the front and back bumper. Car owners can also. Bumper-to-Bumper vs. Powertrain Warranty: What's the Difference? A bumper-to-bumper limited warranty covers the systems and components of the vehicle, from. An auto warranty does not cover periodic maintenance, including oil changes, air filter changes or tune-ups. Unless you buy a factory-backed add-on at the. The manufacturer or dealer must prove the aftermarket or recycled part caused the damage before they can deny warranty coverage. The warranty company could ask. A manufacturer's vehicle limited warranty, also called an auto limited warranty or limited factory warranty, covers defects or damage to your vehicle that occur. Typical powertrain warranties last for 5 years or 60, miles, whichever comes first, but other durations are available. Covered components include:·. Engine —. The Powertrain Warranty covers components such as the engine, transmission, and drivetrain. It begins at the Warranty Start Date and lasts for 5 years or. Year/,Mile Powertrain Limited Warranty Coverage is for 10 years or , miles for most models. Any subsequent owners receive the balance of the. Basic Coverage is 36 months/36, miles, whichever occurs first, from the date of first use and covers all components other than normal wear and maintenance. A bumper-to-bumper warranty can cover the things the powertrain warranty doesn't. It covers everything between the front and back bumper. Car owners can also. Bumper-to-Bumper vs. Powertrain Warranty: What's the Difference? A bumper-to-bumper limited warranty covers the systems and components of the vehicle, from. An auto warranty does not cover periodic maintenance, including oil changes, air filter changes or tune-ups. Unless you buy a factory-backed add-on at the. The manufacturer or dealer must prove the aftermarket or recycled part caused the damage before they can deny warranty coverage. The warranty company could ask. A manufacturer's vehicle limited warranty, also called an auto limited warranty or limited factory warranty, covers defects or damage to your vehicle that occur. Typical powertrain warranties last for 5 years or 60, miles, whichever comes first, but other durations are available. Covered components include:·. Engine —.

A manufacturer's limited vehicle warranty, also called a limited auto warranty or limited factory warranty, covers defects or damage to your car that occur as a. Get the Mopar® extended warranty and explore our vehicle protection services. Learn how to get access to factory-trained technicians & genuine Mopar parts. Whenever there's a warranty, the law says it must be available for you to read before you buy. That's true whether you shop in person or online. Warranties. Warranty Period - The warranty period for repairs is four (4) years or 50, miles, whichever comes first. The warranty begins on the date the vehicle is sold/. We've Got You Covered · 5-YEAR / 60,MILE POWERTRAIN LIMITED WARRANTY · POWERTRAIN LIMITED WARRANTY COVERAGE · 3-YEAR/36,MILE BASIC LIMITED WARRANTY. A powertrain warranty specifically covers components that make a car go, including its engine, transmission, differential and axles. An extended warranty, or. After expiration, the Used Vehicle Limited Warranty provides additional coverage of 1 year or 10, miles. If the Basic Vehicle Limited Warranty has already. warranties, so the only thing you will need to do is enjoy the drive. Keep in mind, Mazda warranty coverage is based on following recommended factory. Factory warranty coverage requires you to take your vehicle to the nearest car dealership for covered repairs. However, this coverage guarantees the use of. Second and/or subsequent owners have powertrain components coverage under the 5-Year/60,Mile New Vehicle Limited Warranty. Excludes coverage for vehicles in. It's more common to find four years or up to 50, miles of limited warranty coverage with a new vehicle. Some automakers only offer three years of factory. Sign into the Mopar Owners Site to find information on your vehicle—from your owners manual to warranty coverage to video tutorials and more. Learn more about Kia's industry leading warranty program that covers road-side assistance, rental cars, and more • year/, mile limited powertrain. In addition, enjoy four years of Audi Hour Roadside Assistance at no additional cost. Learn about New Vehicle Warranty. View of customer at Audi Certified. Protection Plans — Provides additional protection on top of the manufacturer's limited warranty · Prepaid Maintenance — Covers scheduled oil and filter changes. Every new Land Rover vehicle is covered by a New Vehicle Limited Warranty for 4 years or 50, miles, whichever comes first. Each vehicle also carries a six-. Your vehicle is also covered by a powertrain warranty lasting 5-year or 60,miles. Additional factory warranties provide coverage over additional rust. Search for and download your Nissan vehicle's warranty information including CVT, powertrain, LEAF battery and Extended Protection Plans. Every new Land Rover vehicle is covered by a New Vehicle Limited Warranty for 4 years or miles, whichever comes first. Learn more about this warranty.

How Much Does Invitro Fertilization Cost

On average, IVF can cost $$ per cycle. Our fertility specialists can work with you to find an affordable payment option. How much does IVF cost? The cost for IVF starts at $11, and the total cost will vary depending on your insurance coverage and your personalized treatment. The Cost of In Vitro Fertilization ; Initial Consult. $ ; IVF Cycle w/ Fresh Embryo Transfer. $17, ; IVF Freeze All Embryos Cycle. $12, ; IVF Freeze All. With other leading clinics in the Boston area, we have seen costs as high as $15, to $20,+ per IVF cycle, plus the cost of medication. This comes after. The IVF cost is $22, for women 35 and younger, and $24, for women ages 36 to To qualify, women must: Be 35 or younger at the start of the first. Financial Information ; Natural Cycle IVF, $7, ; Minimal Stim IVF, $7, ; Standard Stim IVF, $12, ; Facility Fee, $ Infertility and IVF insurance coverage is not common and a lot of variation is seen in what is covered and what is left for the patient to pay. The average cost. Medication cost ranges from $3, to $5, depending upon a patient's individual response. The start of the IVF cycle is considered the baseline ultrasound. Medication costs: The cost of the medications used during an IVF cycle will differ among patients due to various treatment regimens and medications used. On average, IVF can cost $$ per cycle. Our fertility specialists can work with you to find an affordable payment option. How much does IVF cost? The cost for IVF starts at $11, and the total cost will vary depending on your insurance coverage and your personalized treatment. The Cost of In Vitro Fertilization ; Initial Consult. $ ; IVF Cycle w/ Fresh Embryo Transfer. $17, ; IVF Freeze All Embryos Cycle. $12, ; IVF Freeze All. With other leading clinics in the Boston area, we have seen costs as high as $15, to $20,+ per IVF cycle, plus the cost of medication. This comes after. The IVF cost is $22, for women 35 and younger, and $24, for women ages 36 to To qualify, women must: Be 35 or younger at the start of the first. Financial Information ; Natural Cycle IVF, $7, ; Minimal Stim IVF, $7, ; Standard Stim IVF, $12, ; Facility Fee, $ Infertility and IVF insurance coverage is not common and a lot of variation is seen in what is covered and what is left for the patient to pay. The average cost. Medication cost ranges from $3, to $5, depending upon a patient's individual response. The start of the IVF cycle is considered the baseline ultrasound. Medication costs: The cost of the medications used during an IVF cycle will differ among patients due to various treatment regimens and medications used.

Each cycle of treatment can cost an average of $12, to $15, Many factors can impact IVF prices, including the IVF clinic used, additional IVF medications. That is why we offer all-inclusive IVF with ICSI for $13, per cycle. LEARN MORE. IVF Select. Designed to allow the highest possible pregnancy rates and. A programmed frozen embryo transfer is $4, and includes: blood tests, ultrasounds to measure endometrial thickness prior to the transfer, thaw. The Cost of In Vitro Fertilization ; Treatment. *Estimated Cost ; Initial Consult. $ ; IVF Cycle w/ Fresh Embryo Transfer. $17, ; IVF Freeze All Embryos Cycle. According to FertilityIQ data, the cost of a single cycle of IVF runs around $23,, depending on where you have it performed, and what services you. On average, the cost of a single IVF cycle can range from $ to $ plus medications, additional needed services, and add-on services. On average, the initial cost of one basic IVF cycle can cost between $10,$15, Additional cycles can cost around $7, each. To reduce costs, a couple. IVF costs vary, averaging from $12, and $30, for a single IVF cycle. When comparing cost information from different fertility practices, it's crucial to. That is why we offer all-inclusive IVF with ICSI for $13, per cycle. LEARN MORE. IVF Select. Designed to allow the highest possible pregnancy rates and. The cost of in vitro fertilization (IVF) will vary from clinic to clinic based on the treatment plan recommended for you, as well as the fee structure of the. In the US the average cost of an ivf cycle is $12, Our program is considerably less than this. Ask about pretesting, medication costs, procedure costs. Some. Using donor eggs, even a woman who does not produce her own eggs can benefit from IVF. How Much Does IVF Cost? The cost for every individual will be. The American Society for Reproductive Medicine (ASRM) reports the national average cost of a single IVF cycle to be around $12, This excludes medication. IVF (In-Vitro Fertilization) costs. in Los Angeles, California. Baby teacher Unlike some other states in the US, California does not mandate your health. The cost of in vitro fertilization (IVF) will vary from clinic to clinic based on the treatment plan recommended for you, as well as the fee structure of the. The cost of an IVF cycle at our clinic ranges from $12, to $14, This is an estimate that is subject to change, and this cost includes a variety of. IVF (In-Vitro Fertilization) costs. in Los Angeles, California. Baby teacher Unlike some other states in the US, California does not mandate your health. Despite IVF's relative effectiveness, the average fertility patient undergoes over two cycles and so the cumulative IVF costs for most fertility patients reach. At Houston Fertility Center, an IVF cycle with PGT will cost $13,*. We also offer INVOcell™ treatment for as little as $9,* with PGT. Of course, IVF costs. Total Estimate*, $13, (*does not include medication costs) ; Possible Additional ART Charges: ; ICSI, $1, ; Biopsy, $2,

Roth Ira Tax Shelter

This is unfortunate because Roth IRAs offer tax-free earnings growth and withdrawals in retirement,2 making them a potentially valuable part of a broader. Each offer unique tax benefits, including tax-sheltered growth and earnings. With the Roth IRA, all contributions are already taxed, so when you've. All employees may enroll in our voluntarily tax shelter plans by allocating a portion of salary from federal income taxes while saving for retirement. What's the role of the Roth IRA? The Roth IRA is another after-tax savings option. If you are maximizing your (b) contributions, or you are concerned about. Roth accounts have been a popular way for Americans to generate tax-sheltered investment growth for more than 20 years, both as Roth IRAs and Roth (k)s. Another possible source of tax-sheltered retirement income is an annuity That's because your contributions to a Roth IRA are never deductible. They. Roth accounts have been a popular way for Americans to generate tax-sheltered investment growth for more than 20 years, both as Roth IRAs and Roth (k)s. The deferred salary is generally not subject to federal or state income tax until it's distributed. However, a (b) plan may also offer designated Roth. ROTH contributions combine the saving and investment features of a traditional deferred compensation plan with the tax-free distribution features of the ROTH. This is unfortunate because Roth IRAs offer tax-free earnings growth and withdrawals in retirement,2 making them a potentially valuable part of a broader. Each offer unique tax benefits, including tax-sheltered growth and earnings. With the Roth IRA, all contributions are already taxed, so when you've. All employees may enroll in our voluntarily tax shelter plans by allocating a portion of salary from federal income taxes while saving for retirement. What's the role of the Roth IRA? The Roth IRA is another after-tax savings option. If you are maximizing your (b) contributions, or you are concerned about. Roth accounts have been a popular way for Americans to generate tax-sheltered investment growth for more than 20 years, both as Roth IRAs and Roth (k)s. Another possible source of tax-sheltered retirement income is an annuity That's because your contributions to a Roth IRA are never deductible. They. Roth accounts have been a popular way for Americans to generate tax-sheltered investment growth for more than 20 years, both as Roth IRAs and Roth (k)s. The deferred salary is generally not subject to federal or state income tax until it's distributed. However, a (b) plan may also offer designated Roth. ROTH contributions combine the saving and investment features of a traditional deferred compensation plan with the tax-free distribution features of the ROTH.

Tip: Holding some of your retirement savings in Roth accounts can help you limit how much income tax you'll owe in a given year. Unlike a Traditional IRA, contributions to a Roth IRA are made after-tax and do not provide a tax deduction. However, investments within a Roth IRA grow tax-. In addition, if certain conditions are met, the earnings will be tax-free. To establish a Roth IRA, you must meet income eligibility requirements. Roth IRAs. retirement account into a tax-free piggy bank. This video is based on ProPublica Video Abusing Roth IRA as A Billion-Dollar Tax Shelter. Non. The tax-free deal on the Roth IRA may seem too good to be true, but rest assured that there are at least five good reasons for it to stay that way. A tax shelter provides a way to lower your taxable income and, in turn, the tax you pay. There are many ways to lower your taxes. Roth IRAs offer tax-free earnings, but contributions are not deductible. All Total tax sheltered IRA, at retirement. $87, $63, Total non. Roth IRAs are tax optimization machines, and differ from traditional IRAs, in that you contribute after-tax earnings (again, up to $/year). Retirement Investing. The Omnipotent Roth IRA: Maximizing The Best Tax Shelter In The IRS Code. Jan. 16, AM ETGAIN, GAINL, GAINM, O, VER. can remain in the Roth IRA, earning tax-free. Other types of So, if you don't need the money, it can grow in the tax shelter until your death. Global workers serving overseas are not eligible to make Roth or Traditional IRA contributions when all their taxable income is excluded due to the foreign. With a Traditional IRA, you take a tax deduction on contributions (depending on income level), allowing the account to grow tax deferred. But you pay tax on any. Consider a Roth IRA One of the most important investing concepts is that diversifying your investments can lower your risk. Similarly, having different types. The money in a Roth IRA builds over time, with no income taxes due, and you don't have to pay taxes on withdrawals in retirement, either. The parameters of this. Roth IRAs allow you to contribute after-tax money in exchange for tax-free distributions down the road. So, what's the catch? There are a few. If you run afoul. There is no tax deduction for contributions made to a Roth IRA, however all future earnings are sheltered from taxes, under current tax laws. The Roth IRA can. Any other tax shelters besides HSA/k/Roth IRA? · if you or someone you want to support is going to attend college in the future, you can look. rolled over will become subject to the tax rules that apply to the Roth IRA or the Roth account maintained So if you haven't satisfied your RMD by December. A Roth IRA is a form of individual retirement account in which investors make contributions with after-tax earnings. Eligibility is limited by income. You won't have to pay the 6% tax if you withdraw an excess contribution made during a tax year and you also withdraw any interest or other income earned on the.

Stock Market Magazines Usa

Stock market or forex trading graph and candlestick chart suitable for financial investment concept. Economy. Sponsored. Index Investing as an Active Decision. Technical Analysis of Stocks & Commodities magazine is the savvy trader's guide to profiting in any market. Every month, we provide serious traders with. Bloomberg delivers business and markets news, data, analysis, and video to the world, featuring stories from Businessweek and Bloomberg News. Publications · Thematic insights · Capital at risk: nature through an investment lens · Weekly market commentary · U.S. recession fears overdone · Waves of. Many people who follow the stock market watch the numbers every day, and many popular magazines, television, and radio shows follow the stock market closely. News, analysis and opinion from the Financial Times on the latest in markets, economics and politics. Recent magazine issues from Barron's, the world's premier investing publication providing financial The Stock Market Is in the Homestretch of Where to. MarketWatch provides the latest stock market, financial and business news. Get stock market quotes, personal finance advice, company news and more. Perform stock investment research with our IBD research tools to help investment strategies. We provide the resources to help make informed decisions. Stock market or forex trading graph and candlestick chart suitable for financial investment concept. Economy. Sponsored. Index Investing as an Active Decision. Technical Analysis of Stocks & Commodities magazine is the savvy trader's guide to profiting in any market. Every month, we provide serious traders with. Bloomberg delivers business and markets news, data, analysis, and video to the world, featuring stories from Businessweek and Bloomberg News. Publications · Thematic insights · Capital at risk: nature through an investment lens · Weekly market commentary · U.S. recession fears overdone · Waves of. Many people who follow the stock market watch the numbers every day, and many popular magazines, television, and radio shows follow the stock market closely. News, analysis and opinion from the Financial Times on the latest in markets, economics and politics. Recent magazine issues from Barron's, the world's premier investing publication providing financial The Stock Market Is in the Homestretch of Where to. MarketWatch provides the latest stock market, financial and business news. Get stock market quotes, personal finance advice, company news and more. Perform stock investment research with our IBD research tools to help investment strategies. We provide the resources to help make informed decisions.

The latest finance and stock market news covering the Dow, S&P , banking, investing and regulation. dlkfs.online offers free real time quotes, portfolio, streaming charts, financial news, live stock market data and more. Staff Report on Algorithmic Trading in U.S. Capital Markets (PDF), Special Studies. July 30, , Annual Equal Employment Opportunity. Stock market or forex trading graph and candlestick chart suitable for financial investment concept. Economy. Sponsored. Index Investing as an Active Decision. News & Features. Capital Raising & Corporate Finance · Transaction Banking · Economics, Policy & Regulation · Emerging & Frontier Markets. Best Stock Trading Apps · Best Crypto Exchanges · Best Crypto Wallets · Retirement The 50 Best Places to Live in the U.S.. January This Money. Research Publications. View all. Fund Operations. COLUMN. BY TOPIC US Retail Investment Under Attack from Bunk 'Common Ownership' Theory. In his. Recent magazine issues from Barron's, the world's premier investing publication providing financial The Stock Market Is in the Homestretch of Where to. Publications · Thematic insights · Capital at risk: nature through an investment lens · Weekly market commentary · U.S. recession fears overdone · Waves of. Research Publications. View all. Fund Operations. COLUMN. BY TOPIC US Retail Investment Under Attack from Bunk 'Common Ownership' Theory. In his. Kiplinger · Investor checking performance of financial portfolio online whilst reviewing investment statement. Where to Find High Yields For Savings And. Receive data-driven research · Hear directly from the investment community · Benchmark against your peers · Multi-user access · Full access to all digital event. WSJ online coverage of breaking news and current headlines from the US and around the world. Top stories, photos, videos, detailed analysis and in-depth. Publishing: Books/Magazines Stocks · Educational Development Corp. EDUC. Price: $ · Pearson plc - ADR PSO. Price: $ Daily change · John Wiley & Sons Inc. Fortune · Fortune Magazine · Magazine · The rise of Joshua Kushner: How the young VC quietly built Thrive Capital into the powerhouse leading OpenAI to a $ We teach sound, practical investing skills to support a long-term investment strategy. Our education includes stock investing classes and webinars for all. dlkfs.online offers free real time quotes, portfolio, streaming charts, financial news, live stock market data and more. Investment Magazine provides in-depth, monthly analysis of trends and developments for all the businesses in which superannuation funds engage‚ including. CNBC is the world leader in business news and real-time financial market coverage. Find fast, actionable information. Shares provides unbiased commentary, ideas, views and news on stocks, funds, pensions and savings. Great investment tools with live data. Free registration.

How Much Is Minimum Ira Distribution

Review a required minimum distribution table that compares IRAs and defined contribution plans, such as (k), profit sharing and (b) plans. Required minimum distributions are mandatory withdraws you must take from your pre-tax IRA or K accounts each year. Your current required minimum distribution is $3, This is the fair market value of your account as of the close of business on December 31st of the. As you begin taking your RMDs, you will need to decide how you'll use this money. You are not required to distribute cash from the IRA to satisfy your RMD. Cash. Known as required minimum distributions (RMDs), this rule requires retirees to start withdrawing money and paying taxes on these withdrawals when they reach a. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from some types of retirement accounts annually. A required minimum distribution is a specific amount of money you must withdraw from a tax-deferred retirement account each year, beginning at age Traditional IRAs and employer plans like a (k) allow you to put off paying federal taxes, often for decades. Generally, your required minimum distribution . A required minimum distribution is the amount you must withdraw from your retirement accounts annually starting at age Review a required minimum distribution table that compares IRAs and defined contribution plans, such as (k), profit sharing and (b) plans. Required minimum distributions are mandatory withdraws you must take from your pre-tax IRA or K accounts each year. Your current required minimum distribution is $3, This is the fair market value of your account as of the close of business on December 31st of the. As you begin taking your RMDs, you will need to decide how you'll use this money. You are not required to distribute cash from the IRA to satisfy your RMD. Cash. Known as required minimum distributions (RMDs), this rule requires retirees to start withdrawing money and paying taxes on these withdrawals when they reach a. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from some types of retirement accounts annually. A required minimum distribution is a specific amount of money you must withdraw from a tax-deferred retirement account each year, beginning at age Traditional IRAs and employer plans like a (k) allow you to put off paying federal taxes, often for decades. Generally, your required minimum distribution . A required minimum distribution is the amount you must withdraw from your retirement accounts annually starting at age

Starting at age 73, Uncle Sam requires taxpayers to draw down their retirement account savings through RMDs — annual required minimum distributions. Your required minimum distribution is $3, Updated for the SECURE Act and CARES Act. *indicates required. Plan. Are you wondering how much you'll need to withdraw from your (k) or IRA during retirement? We'll explain how required minimum distributions (RMDs) work, why. What is a Required Minimum Distribution? Individuals who save in a tax-qualified retirement account are required to begin withdrawing a minimum amount each. Use our RMD calculator to find out the required minimum distribution for your IRA. Plus review your projected RMDs over 10 years and over your lifetime. How are RMDs taxed? If all your IRA contributions were tax-deductible when you made them, the full amount of the RMD will be treated as ordinary income for. It's important to be proactive about taking required minimum distributions once you turn · You must generally begin taking RMDs from retirement accounts each. RMDs and Roth accounts: When can I withdraw from a Roth IRA? · RMDs and Inherited IRAs: Cashing out an Inherited IRA · How are RMDs taxed? · Using RMDs for. Financial institutions that offer IRA or (k) accounts often notify their customers when an RMD is due. Many provide a calculation of how much needs to be. Use our required minimum distribution (RMD) calculator to determine how much money you need to take out of your traditional IRA or (k) account this year. Use this calculator to determine your Required Minimum Distribution (RMD) from a traditional (k) or IRA. A required minimum distribution (RMD) is the minimum amount you must withdraw from your retirement account(s) to satisfy federal tax rules once you reach your. Once you reach age 73Footnote * the IRS requires you to withdraw a minimum amount each year from certain IRAs. These withdrawals are called required minimum. How RMDs are Calculated · Determine the individual retirement account balance as of December 31 of the prior year · Find the distribution period (or "life. Required Minimum Distributions or RMDs are withdrawals you must take from your retirement How much is my RMD? Your RMD is calculated based on your age, your. In December , retirement legislation — known as SECURE Act — was signed into law, changing the rules on how investors can save for their retirement. The. These amounts are known as your Required Minimum Distributions (RMD). Use this calculator to determine your current RMD and estimate your future RMDs. If you've reached age , it's time to start withdrawals—the IRS requires you to begin taking Required Minimum Distributions (RMDs) from your IRA and. The new law also provides that the RMD age will change again to 75 in **Distributions using Auto-RMD are not yet available for Retirement Advisory.

2 3 4 5 6